The Other Swans That Define Us

Imagine you logged the outcome of many casino visits where you played roulette until you were up at least $20 or lost $1500. You would naturally end up leaving ahead most of the time, and occasionally would lose a lot.

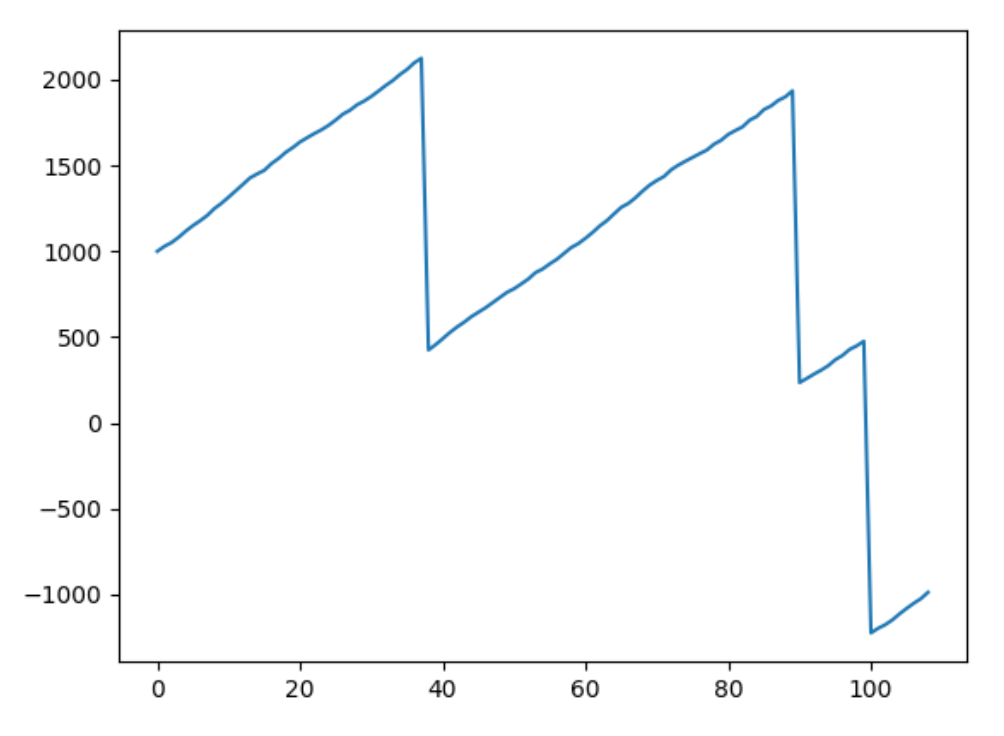

Here’s one possible outcome over 100 casino visits:

As expected, most times you win a small amount, and occasionally—3 times in this case—you lose a lot.

You want to improve your system, so try to figure out how to avoid those big losing days. Suppose all three happened to be on Wednesdays (or any other specific day, or when you were wearing one certain shirt, or when your forgot to call your mom that day — surely you can find some commonality between the 3 bad days). You re-run your analysis of historical outcomes, and if you skipped Wednesdays, you would always win. You’ve found your infinite money glitch.

This is silly. Of course that doesn’t work, and no rational person would try this earnestly, thinking they could actually always win.

Yet, they do. There’s an adage in finance that you can’t destroy risk, just move it around. In your roulette strategy, you moved the—very real, still existent—risk to be out of sight. It’s there, looming and waiting, just no longer obviously visible.

“I would argue that we have to reduce complexity and face the fact that it’s actually good for institutions to experience risks.”

— Wallace Turbeville, Meet the 80-Year-Old Whiz Kid Reinventing the Corporate Bond Market

The issue is that the history we’re looking at captures a long time, so it’s easy to make a the error to think the sample can reasonably predict the future. The duration gives false confidence that the underlying sample is robust enough to extrapolate.

When circumstances that determine large overall outcomes—positive or negative—are infrequent, we leave room for narrative about how we’re great, how we understand how the world really works, how our hard work paid off. The casino strategy was deliberate, but hiding and finding pivotal incidents happens all around us.

Nassim Nicholas Taleb introduced most of the world to Black Swans — difficult to predict, improbable, and highly impactful events that define our world. So I’ll call attention to the other swans: those that didn’t happen, ubiquitously happened, or simply happened in a way that formed our perspective far outside our recognition.

A fund I know of invested early in Amazon, and decided to hold forever, believing Amazon would become a once-in-a-generation company. And they did. The fund became well-regarded for spotting tech trends, for “seeing through the noise”. The manager gets invited to fancy events to speak, having built his career on only a few (in retrospect, good) decisions. We obviously don’t get to hear the stories of the funds that felt the same way about companies that never outgrew their initial niche.

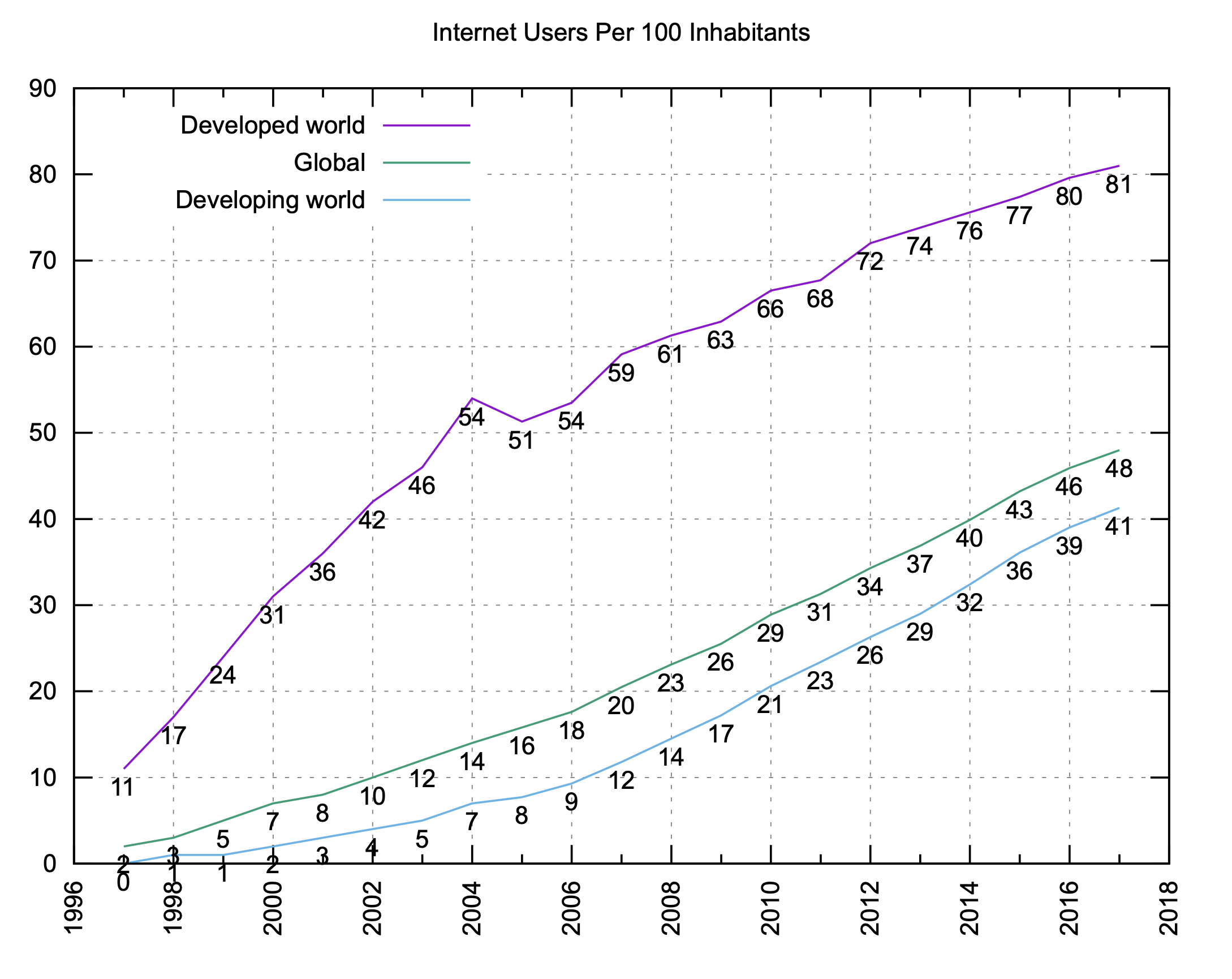

This isn’t all about hiding risk. It’s also about how the water we swim in is dominated by a few events. We’ve had one internet boom, so much of our wisdom about how tech works is based on the wave we’re currently in. In fact, prior recessions and tech bubbles don’t even show up in historical global internet adoption.

Inside the internet growth curve, we’ve had only a few fundamental shifts (social and communication, e-commerce, etc). People who hitched their careers to the right trend did well. If you started a seed venture fund in 2018 and were able to index across plausibly-good-ideas and smart founders, you would have done well — regardless of your investing skill, and in a way that you likely couldn’t reproduce.

In large companies, especially at senior levels, success is ideally tied to performance. But, it’s also inextricably linked to the specific projects a person happens to work on. Get in early on to a project that will turn out well, have a lot of quantifiable impact, get promoted. The same goes for tech careers in startups: there’s no faster way to move up a career ladder than be at a company experiencing explosive growth.

Over 14 years, I’ve had a total of 8 managers. A few were alright, one or two weren’t great, and the rest were pretty fantastic. None were awful, though. Even though I’m now older than most individual contributor software engineers that I’ve worked with in recent years, my sample size of “how to work well with your manager” is 8. This is well within the range where rules-of-thumb and advice that I want to give could just be due to randomness.

Humanity itself is only roughly 500 generations deep into the agricultural revolution. Modern democracies are only about 10 human generations old. We’ve had one industrial revolution, and never had to fully deal with its consequences—positive and negative—yet. Globalization is, on even human timescales, new. Nuclear energy has been controllable by humans for around 80 years. We’ve had only one or two generations socially deeply impacted by social media—though the mental health trends are not looking good. We’re just beginning to taste what post-scarcity might look like. We don’t yet know the impacts of AI, and if this will indeed be the most important century.

For as much as we know, we also know so little.

Where does that leave us? With a large cup of epistemic humility. We want assurances: scientific knowledge of what reproduces well. Where should we invest our money? What skills should we teach our children? What diets are optimal?

Rationality will only take us so far when we’re surrounded by unknowns. In fact, we don’t even know where all the missing Black Swans are, or where we’ve gotten exceedingly lucky. Perhaps without the Haber–Bosch process and penicillin, the world would look very different today.

It’s odd where we find ourselves, where so much of what happens is out of our control. Many authoritative experts may have largely just been at the right place at the right time. Certainly this is present in politics — people elect a person, yes, but often they’re electing a trendy idea.

I find this liberating, in a “meditating on equanimity” sort of way. Besides showing up and doing good work, building meaningful relationships, and making meaning, we’re along for the ride. A clear lesson from this realization is to be aware of the lotteries we’ve won, be humble about how much we understand, and be intentional about where our risks lie. And don’t try to beat casinos.